New trading platforms interest investors. One of the most popular ones is the world’s leading social trading platform eToro, which offers a wide selection of tools for investing in capital markets. We do not recommend eToro for first-time investors, but even a beginner can practice investing safely with an eToro virtual portfolio.

On eToro’s investment platform, investors can invest in various asset classes, such as stocks and cryptocurrencies, with very low fees. For example, eToro does not charge a commission for stock transactions. Investors that register through Sijoittaja.fi also receive benefits regarding trading costs.

The investor can also practice international investing in the service by building a virtual portfolio, whose initial capital is 100,000 dollars. We compiled instructions on how you can easily familiarise yourself with eToro as an investment platform with a virtual portfolio.

Practice investing with a virtual portfolio in eToro

When you create an eToro user account, a demo account with 100,000 dollars in virtual cash is automatically created for you. With the virtual cash you can familiarise yourself with trading before you risk any real cash. You can use the demo account for both traditional trading as well as Copy Trading, which is based on copying.

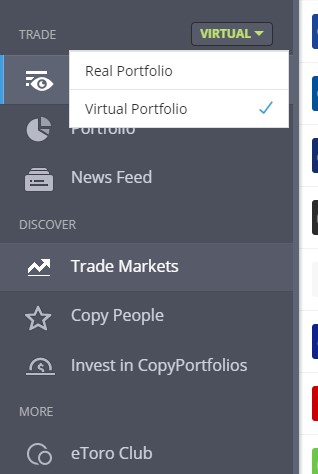

After you sign in to the website, you will find the demo account by selecting “virtual portfolio”.

Try advanced trading

activities

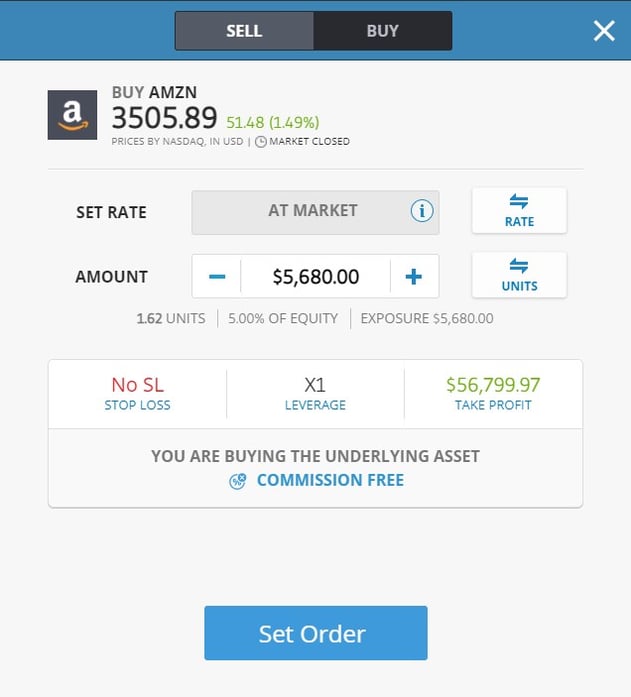

You can easily practice buying and selling stocks with a virtual portfolio. You can buy a stock by clicking the “Trade” button next to the stock.

The purchase price is shown in the box, and the price is updated in real time. The investor can enter the desired investment amount or number of units. Note! You do not have to buy stocks in equal amounts, as in eToro you can buy parts of stocks.

At the time of purchase, eToro also tells investors the investment’s percentage of the portfolio’s capital. This makes portfolio allocation and risk management easier.

On eToro, the investor may also directly enter a short sale or buy stocks with leverage. In this case, the investor does not, however, buy a real stock, but instead makes a CFD trade, which cannot be recommended for tax reasons. Some stocks are CFDs in the eToro service. Click here to read more about CFDs and which stocks are real and which are CFDs in eToro.

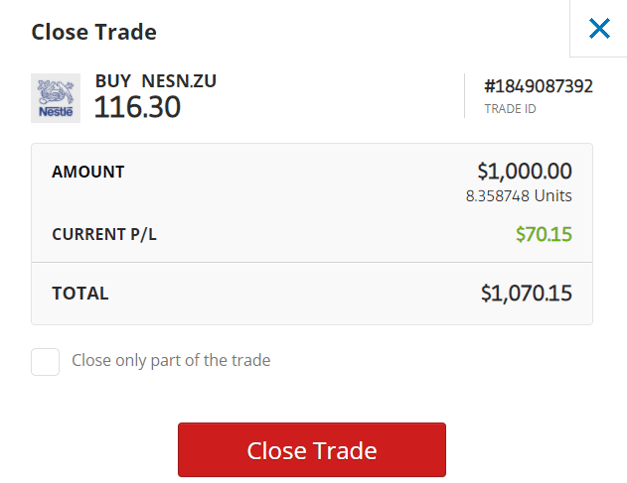

When a stock is sold, eToro uses the term “close”. The investor thus “closes the investment”. The investor may close the entire investment or part of it.

Copy the portfolios of partners and other investors

One of eToro’s most interesting features is social investing and the opportunity to follow other investors and copy portfolios.

Sijoittaja.fi’s international investment portfolios can also be found in the CopyPortfolio section. When we make changes to the portfolios, trading also takes place, if desired, automatically in your own portfolio. The most popular portfolio is II-Disruptive, which invests in disruptive technology stocks.

Finnish investors should always check whether the stocks are real or CFDs. Only real stocks are used in Sijoittaja.fi’s international portfolios.

The portfolios can be found in eToro’s partner section. Instructions for finding Sijoittaja.fi’s portfolios in eToro.

This is how you begin feeless trading with stocks

- Open your account: registration is free

- Take advantage of the benefits negotiated by Sijoittaja.fi (eToro reports the benefits manually every month) and register through the link below.

- Make the first deposit

- You can start trading with 50 dollars

- The minimum investment in Sijoittaja.fi’s international investment portfolios is 500 dollars.

- In addition to stocks and ETFs, you can also, for example, trade cryptocurrencies.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

eToro is a multi-asset platform which offers both investing in stocks and as well as trading CFDs

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 78% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy trading is a portfolio management service, provided by eToro (Europe) Ltd., which is authorised and regulated by the Cyprus Securities and Exchange Commission.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.